When you earn enough interests from foreign bank accounts, you will need to report the earnings to IRS through the Form 8938 – Statement of specified foreign financial assets. For instance, if you are married and file a joint income tax return, you will need to report the interests if the aggregate value of your accounts is more than $50,000 on the last day of the tax year or more than $75,000 at any time during the year.

The form is pretty simple to file. If you have to report multiple foreign bank accounts, you will need to add continuation pages for additional accounts. This is easy when you file paper tax return because you can print those extra pages. However, it is a little confusing when you e-file with software like H&R Block. In this case, you fill in the information in the form 8938 as usual.

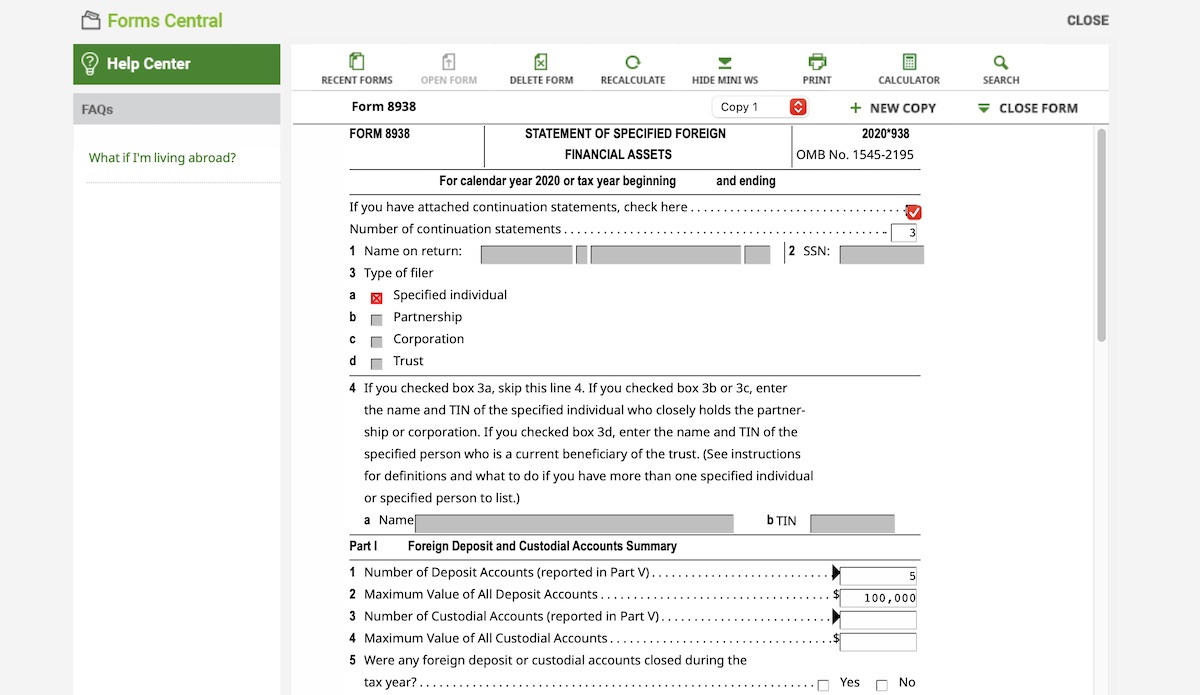

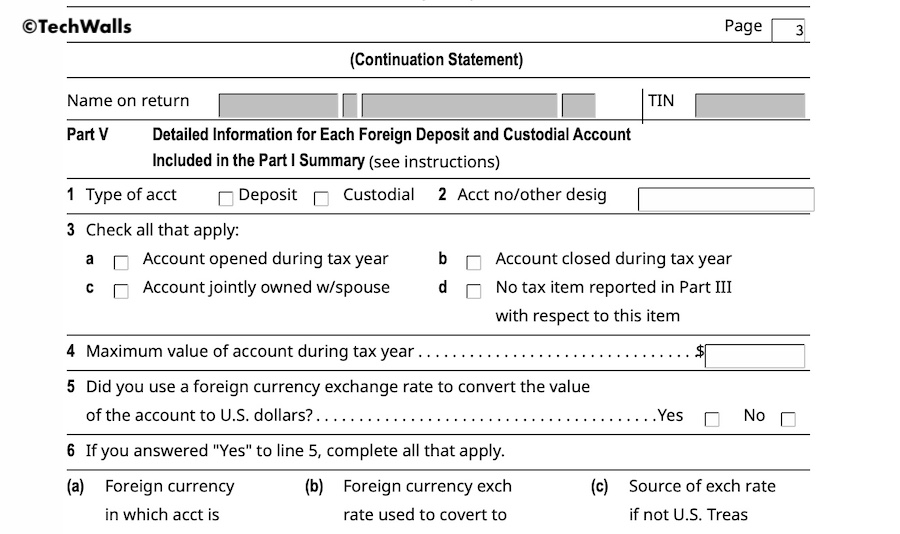

Check the attached continuation statements checkbox and enter information to other parts. For instance, I am reporting 5 foreign accounts here with the maximum value of $100,000, the interest I received in the year, then proceed to part V for detailed information of each account. The 1st account is reported on page 1 and 2. Page 3 is the first continuation statement and I’m reporting my 2nd account here. Write page 3 on the top right corner.

Now, to create the next continuation statement for the 3rd account, you click on New Copy button on top. The software is going to generate the entire Form 8938 but you can skip the 1st and 2nd page and go to page 3 for the next continuation statement. Write page 4 on the corner and fill in information.

To report the 4th and 5th account, you will do the same process by creating another copy and fill in information on page 3 only. Write page 5 and page 6 correspondingly on the corner. So, we are using 4 continuation statements in total, you can come back to the first copy of the form and write 4 as the number of continuation statements.

All done, now you can save the forms and they will be submitted along with your tax return. I used H&R Block Tax Software Premium to file my tax and the process should be the same for other editions and software.

Disclosure: We might earn commission from qualifying purchases. The commission help keep the rest of my content free, so thank you!

Andrei Ferraro says

Thank you for the clear and logical explanation of using Form 8938.

I am sure it will help a lot of people to fill this Form.

Just a question: I want to delete a Copy I added and I don’t know how.

Could you please help me?

Thank you,

Andrei

Tuan Do says

Hi Andrei,

You just need to select the form and choose Delete Form on the top toolbar.

Eliana says

Hi, thank you for providing clear guidance. This solution is exactly what I am looking for. I used the same software H&R Block Premium download version. I filled out Form 8938 and saved it in my entire package. However, I was confused when I submitted to efile, I cannot see Form 8938 including in the list of the entire return submitted to IRS Form Print-out. Are you sure the form 8938 was attached when we submitted it using electronic filing in hrb premium software? Do I need to do any manual attachment in the hrb software to electronic filing form 8938 with my 1040 return? But I do not find anywhere for attachment in the file tab. I hope to hear back. Thank you!

Tuan Do says

You need to check your final forms before submitting, they must include all the 8938 forms that you filled in. I added these forms when it asked me about foreign financial accounts.

Ashok says

Is there a solution to add additional sheets for 8938 forms in for 2021 H&R block tax software ? 2021 software does not have the provision to add page number for the continuation sheets that was possible in last years H&R block software.

Saji says

Have you had issue e-filing with line 36 entries on 2021 8938 form? H&R Block software is saying you can’t e-file if you have line 36 entries but there were no issues last year.